Understanding Decision-Making in Finance: From Theory to Practical Risk Solutions

In the realm of financial risk management, understanding how decisions are made under uncertainty is vital. Two cornerstone theories—Expected Utility Theory (EUT) and Prospect Theory (PT)—offer contrasting perspectives on investor behavior. At Amsshare, we harness these insights to enhance custom risk solutions for clients navigating complex financial markets, including UCITS, investment funds, and institutional portfolios.

Expected Utility Theory: Rational but Limited

EUT, developed by Von Neumann and Morgenstern, is a normative model explaining how investors should make rational decisions. Based on axioms such as completeness, transitivity, continuity, and independence, EUT assumes that investors weigh outcomes purely based on wealth and probability. It supports the foundation of mean-variance utility theory, where individuals prefer higher returns but are averse to volatility—an essential principle in market risk analysis.

However, real-world applications of EUT often falter. Through well-known behavioral tests, research reveals that investors frequently deviate from rational patterns. Whether it’s choosing a guaranteed smaller gain over a risky higher one or preferring a gamble to avoid a loss, these behaviors expose the limitations of traditional models. In our effective risk solutions, we account for these human factors to deliver strategies that align with how decisions are actually made.

Prospect Theory: A Behavioral Finance Breakthrough

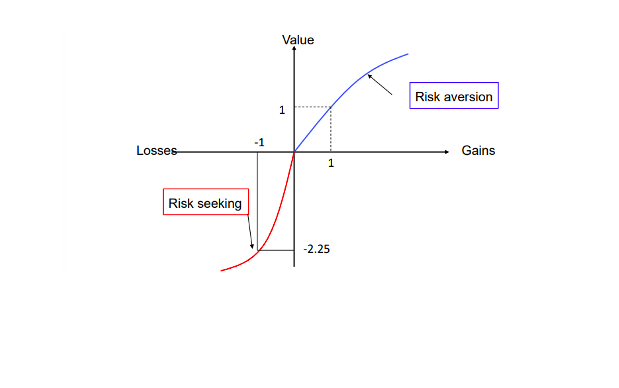

Developed by Kahneman and Tversky, Prospect Theory redefines financial decision-making as it is, not as it should be. Unlike EUT, PT emphasises that utility is driven by gains and losses rather than total wealth. It introduces key behavioral insights:

Risk aversion over gains

Risk-seeking over losses

Loss aversion, where losses weigh more heavily than equivalent gains

These dynamics are critical in structuring risk assessments, where investor sentiment can disproportionately impact fund flows and asset valuations. Moreover, PT incorporates probability weighting, showing how individuals tend to overweight low probabilities and underweight high probabilities. This insight is particularly useful when modeling tail risks and extreme market events—an area where AI solutions and machine learning models at Amsshare excel in identifying subtle behavioral biases within large datasets.

Implications for Risk Management and Investment Strategy

At Amsshare, we leverage both EUT and PT to deliver custom risk solutions that are grounded in theory but shaped by reality. For example:

In credit risk analysis, PT helps explain investor reactions to rating changes or default probabilities.

In market risk, we apply EUT principles while adjusting for behavioral deviations using historical data patterns.

Our AI solutions integrate psychological models to enhance predictive accuracy in financial risk management.

Bridging Theory and Practice with Amsshare

While the academic nature of decision-making theories might seem abstract, they are embedded in the DNA of effective risk strategies. At Amsshare, we don’t just understand these models—we apply them to help clients make better, data-driven decisions. Whether you’re navigating regulatory disclosures for UCITS funds, optimising portfolios, or building AI-enhanced investment tools, we ensure your decisions are not just theoretically sound—but practically robust.