Next-generation portfolio and risk management

Built for forward-looking asset managers. Replace Excel based processes with AI-driven workflows for consistent and timely decisions.

Research findings on AI in asset management

- THE PROBLEM & SOLUTION

Consistent and timely decisions with AI-driven workflows

Portfolio and risk processes are still dominated by Excel and manual steps, making them slow, error-prone and difficult to scale across teams and use cases.

Amsshare enables asset managers to apply AI-driven workflows that automatically analyse data and translate it into consistent and timely outputs. These outputs support decision-making across portfolio management, risk, compliance, executive reporting and client communication.

PORTFOLIO MANAGEMENT

Get portfolio insights fast, without manual work

The workflow automatically analyses your portfolio data and turns it into clear results for portfolio teams. Instead of building analyses themselves, teams review ready-made insights to steer allocations, track performance and understand risk.

Monitoring portfolio structure and key exposures

Track how portfolio composition and key exposures evolve over time and whether changes remain within agreed limits and constraints.

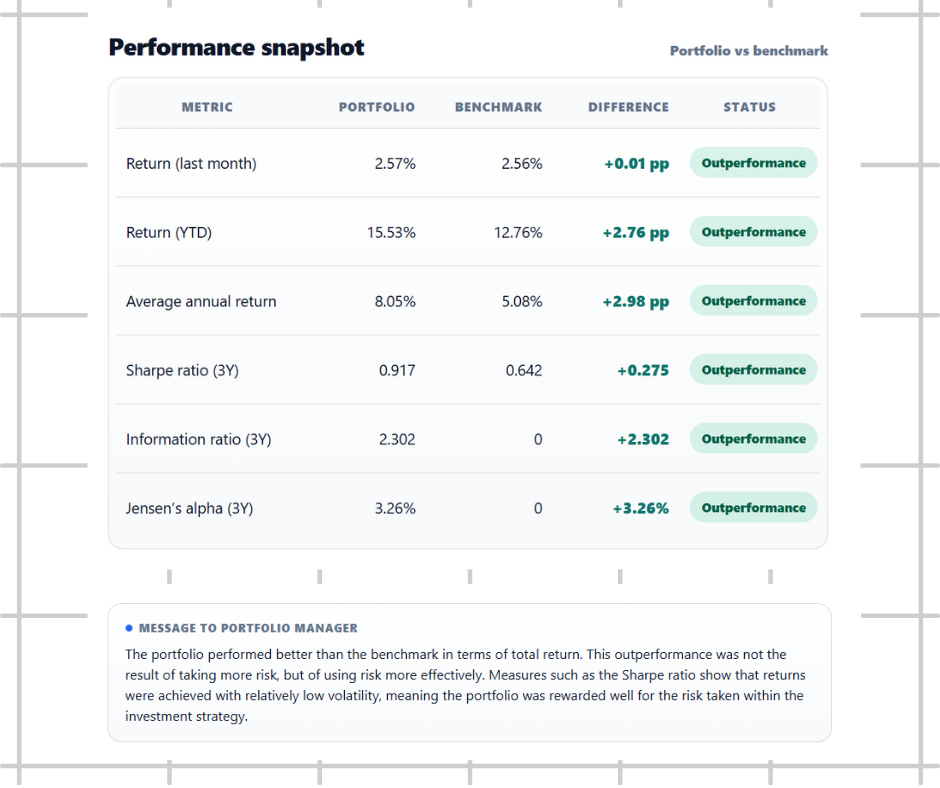

Evaluating performance vs benchmark

Analyse performance relative to benchmarks to clearly identify out- or underperformance.

Assessing risk-adjusted performance

Evaluate whether returns are achieved efficiently by analysing performance in relation to risk, including risk-adjusted metrics.

RISK MANAGEMENT

Easily manage financial risks

The workflow continuously analyses portfolio data to identify, measure and monitor risk. Risk teams receive clear views for oversight and internal reporting, so they can focus on understanding exposures and acting on risks rather than assembling analyses.

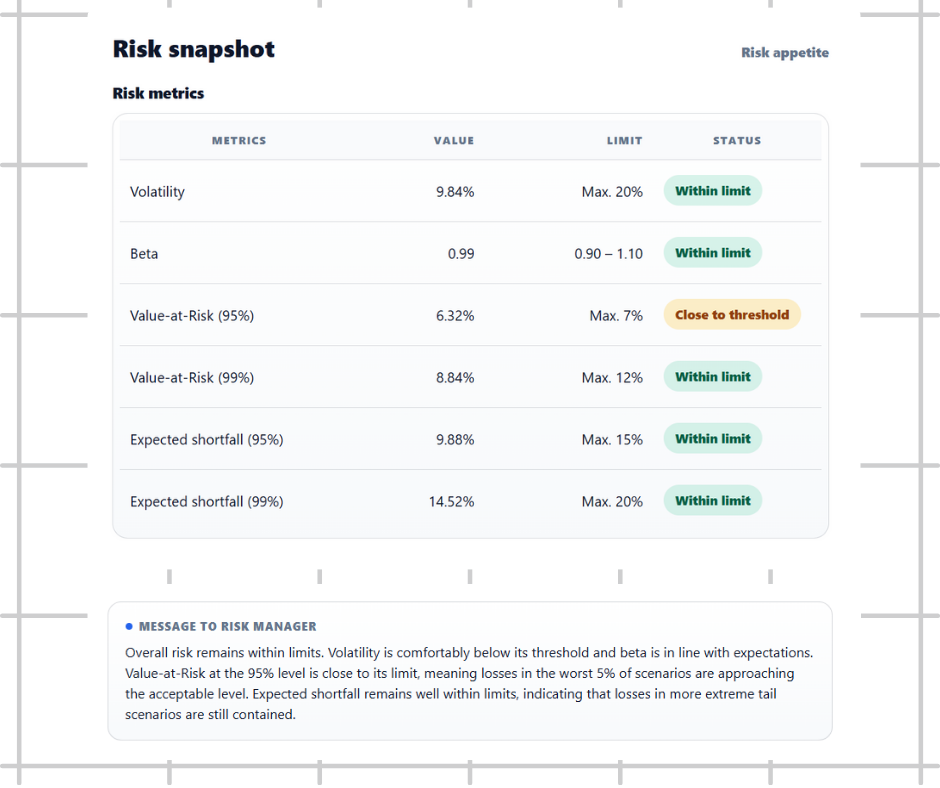

Identifying and monitoring key risks

Provides ongoing insight into the main risk drivers within portfolios and how these develop over time.

Assessing risk against limits and constraints

Compares risk levels with internal limits and guidelines to identify breaches or emerging issues.

Evaluating risk under different conditions

Run stress and scenario analyses to show how portfolios behave under changing market and macro conditions.

COMPLIANCE

Reproducible regulatory oversight

The workflow turns analytical results into structured compliance outputs. This makes risk oversight reproducible and auditable, and supports the execution of regulatory calculations required by authorities.

Demonstrating robust risk governance

Creates consistent documentation and reports that show how risk processes are applied, supporting internal and regulatory oversight.

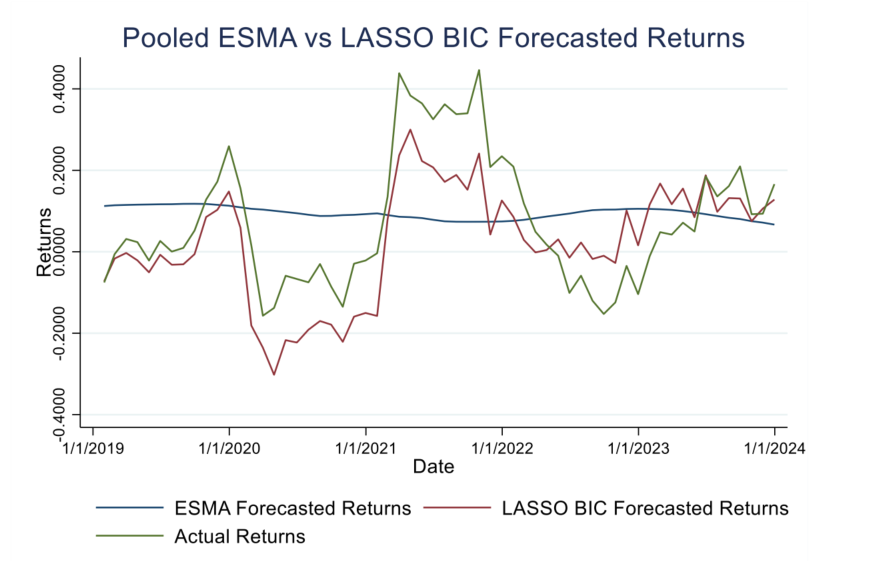

Meeting regulatory requirements

Supports the execution of ESMA required calculations.

- Key Information Documents (KID/EID)

- Liquidity Stress Testing

- Liquidity Management Tools

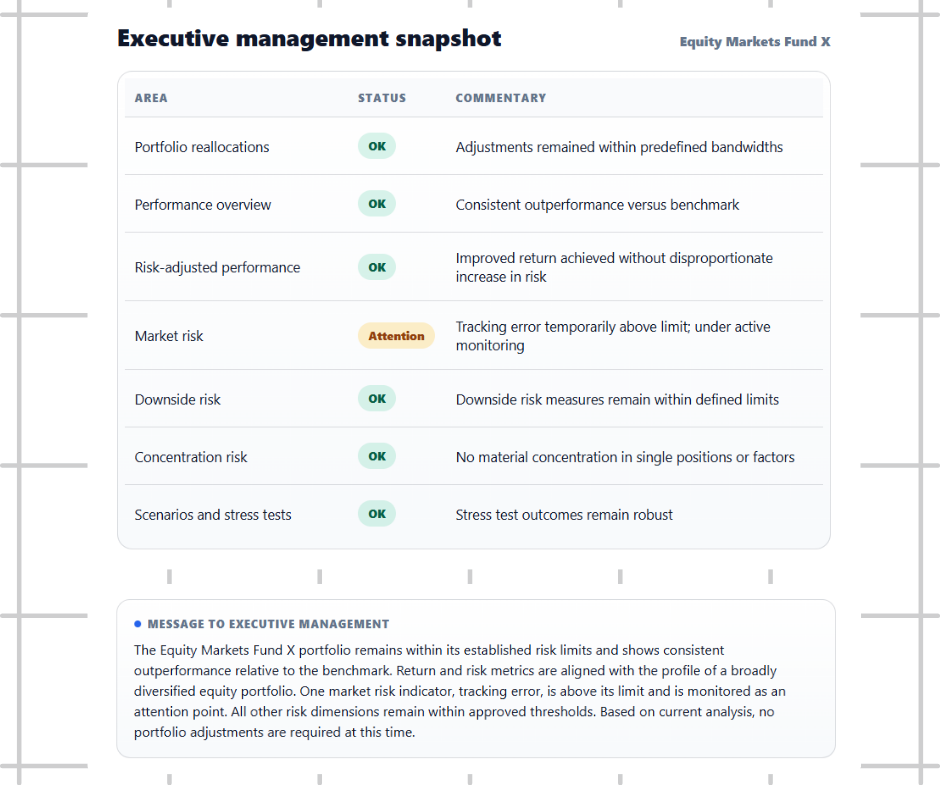

EXECUTIVE MANAGEMENT

Timely management oversight

The workflow turns analysis into concise management-level insights. Executive teams stay informed on key portfolio and risk developments without having to review underlying analyses, dashboards or reports.

High-level portfolio and risk overviews

Provides clear summaries of key developments across portfolios, performance and risk to support effective oversight.

Focus on material changes and exceptions

Highlights significant movements, breaches or deviations that require attention, rather than routine developments.

Timely and targeted updates

Delivers concise updates automatically, so executives are informed at the right time without additional effort.

CLIENT COMMUNICATION

Efficient and trusted client reporting

Client communications are generated directly from validated insights. This ensures clients receive consistent reporting, without separate reporting processes or reconciliation between teams.

Consistent and reliable client communication

Delivers client-facing reports that are aligned with portfolio, risk and management views, ensuring one consistent story and trusted numbers.

Factsheets and periodic updates

Supports efficient production of factsheets, periodic updates and other client communications, without duplicating analysis or manual adjustments.

A word from our clients

I can wholeheartedly recommend Amsshare as a valuable advisor at the intersection of regulation, risk management and compliance tooling."