Key Takeaways for Investment Funds

Investment funds must publish scenario analyses in their Key Information Documents (KIDs) under ESMA regulations. ESMA’s historical simulation model is the current standard, but is it the best forecasting method?

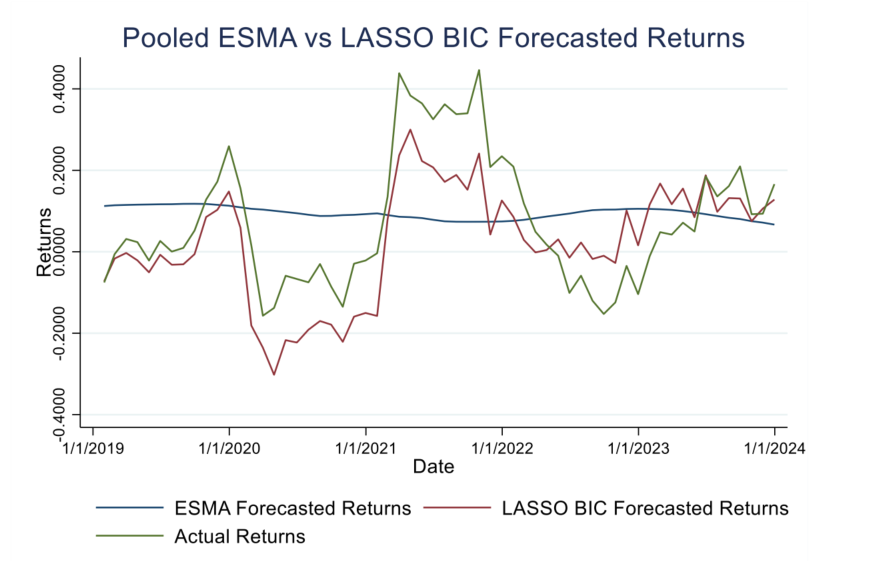

Our analysis compared ESMA’s historical return approach to LASSO BIC forecasting, a more data-driven methodology. Here’s what fund managers need to know:

✔ LASSO BIC provides more accurate return estimates, especially for volatile funds.

✔ It reduces forecast error rates compared to ESMA’s historical model.

❌ However, ESMA’s method remains the only compliant approach for KIDs—alternative models should only be used internally.

Although ESMA’s methodology is the required standard, there are ways to enhance scenario analyses internally to improve risk assessments and provide investors with more reliable insights.

📖 Read the full study: Download the complete research (PDF).