A brief summary

In the world of modern asset management, accurate valuation models are essential for managing risk and making informed investment decisions. This article offers a practical deep dive into the calculation and application of unlevered and levered CAPM betas, using Adyen’s 2022 financials as a real-world case study. By analyzing how debt impacts systematic risk through the Hamada formula, we provide a clear framework for fund managers and financial professionals to assess the cost of equity—a key input in the CAPM valuation model to compute the Weighted Average Cost of Capital (WACC) of a firm.

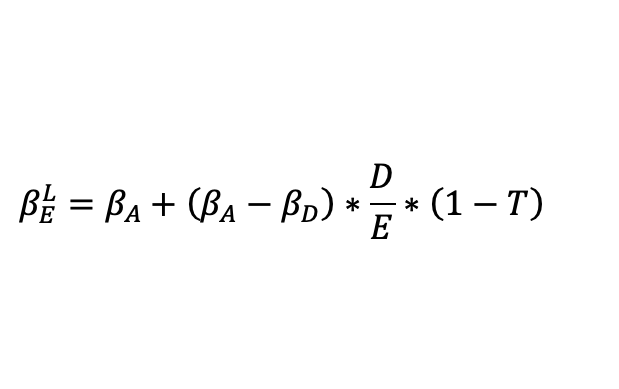

Understanding the difference between unlevered and levered betas is critical for investment funds aiming to differentiate between business risk and financial (leverage) risk. The unlevered beta isolates a firm’s market risk exposure stemming from its core operations, while the levered beta captures additional volatility arising from capital structure decisions. This distinction is vital when benchmarking peer companies or adjusting risk parameters across diverse portfolios.

For fund managers, this methodology supports better risk-adjusted return calculations, particularly when managing exposures to credit, market, or liquidity risk. It also plays a foundational role in scenario analysis and stress testing, especially in line with regulatory frameworks like DORA (Digital Operational Resilience Act), which requires robust, transparent modelling of potential financial impacts under various market conditions.

At Amsshare, we leverage this type of financial modelling expertise to support investment firms, asset managers, and financial institutions in complying with risk disclosure standards such as those found in Key Information Documents (KIDs). Our approach combines quantitative finance techniques with AI-powered solutions, enabling dynamic, scalable, and regulator-ready risk models that can be adapted across portfolios, sectors, and regions.

This article underscores the importance of using forward-looking, analytically sound techniques to enhance valuation accuracy, reduce model risk, and support strategic decision-making within your fund’s investment lifecycle.