How Fund Managers Should Approach ESMA’s New LMT Guidelines

Estimated read time: 8 minutes What you need to know The European Securities and Markets Authority (ESMA) has introduced new guidelines that require UCITS and AIFMs to take a much more practical and fund-specific approach to choosing Liquidity Management Tools (LMTs). The aim is simple: improve how funds manage liquidity risks and reduce the chances of […]

Macro-economic model selection for Point-in-Time forecasting under IFRS-9

Read Article A brief summary An introduction to IFRS-9 In today’s rapidly evolving financial landscape, effective risk management is more crucial than ever. With the implementation of the International Financial Reporting Standard 9 (IFRS 9), financial firms such as banks are required to move from a static, historical view of default risk—Through-the-Cycle (TtC) Probability of Default […]

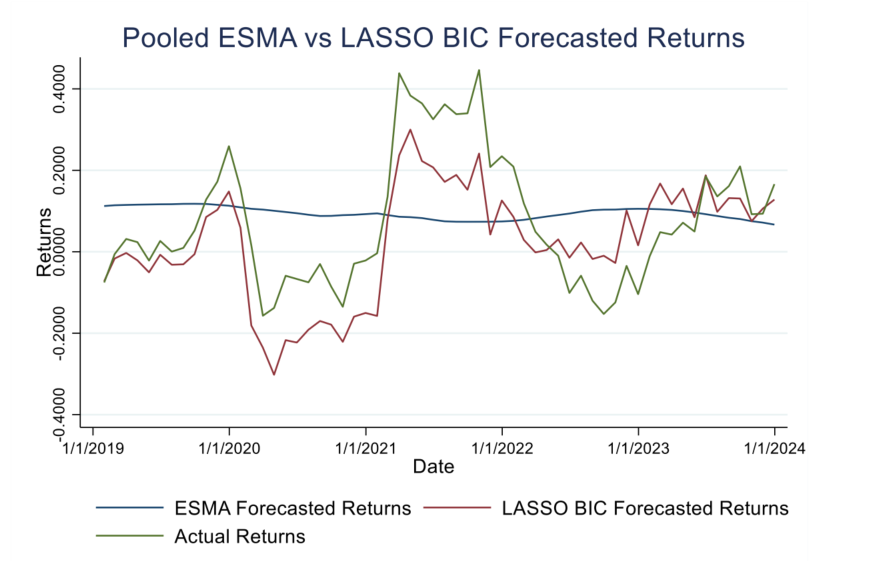

ESMA vs LASSO BIC Forecasting

Key Takeaways for Investment Funds Investment funds must publish scenario analyses in their Key Information Documents (KIDs) under ESMA regulations. ESMA’s historical simulation model is the current standard, but is it the best forecasting method? Our analysis compared ESMA’s historical return approach to LASSO BIC forecasting, a more data-driven methodology. Here’s what fund managers need […]

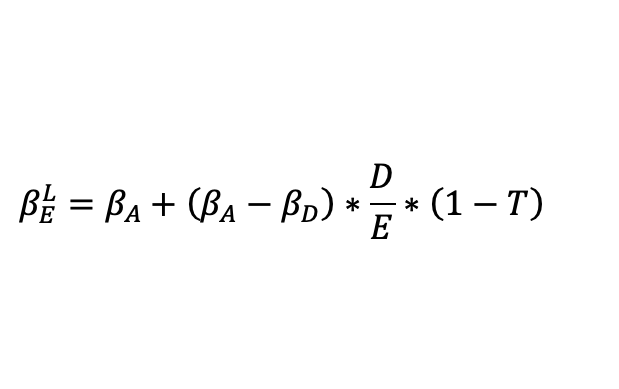

The unlevered and levered CAPM betas: Real-life example of Adyen 2022

Read Article A brief summary In the world of modern asset management, accurate valuation models are essential for managing risk and making informed investment decisions. This article offers a practical deep dive into the calculation and application of unlevered and levered CAPM betas, using Adyen’s 2022 financials as a real-world case study. By analyzing how […]

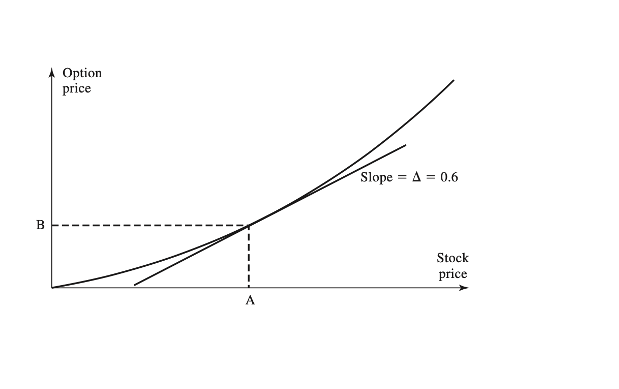

Delta Hedging: Managing Market Risk with Derivatives

Read Article In today’s volatile markets, investment funds and fund managers face increasing exposure to market risk, making robust hedging strategies a vital part of effective risk management. This article explores Delta Hedging—a dynamic technique used to neutralize the price sensitivity of option positions. Through a clear breakdown and practical example using the Black-Scholes model, […]

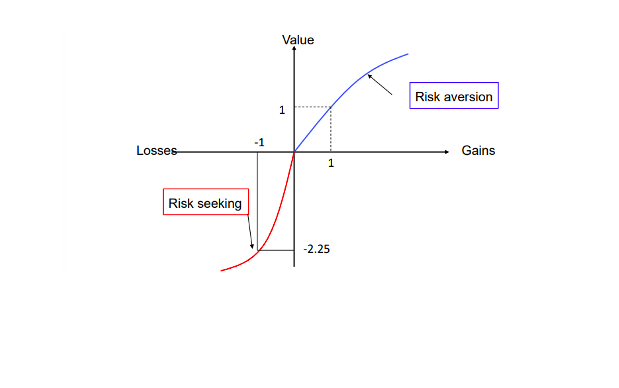

From Ideal to Reality: Understanding Decision-making Theories in Finance

Read article Understanding Decision-Making in Finance: From Theory to Practical Risk Solutions In the realm of financial risk management, understanding how decisions are made under uncertainty is vital. Two cornerstone theories—Expected Utility Theory (EUT) and Prospect Theory (PT)—offer contrasting perspectives on investor behavior. At Amsshare, we harness these insights to enhance custom risk solutions for clients navigating […]

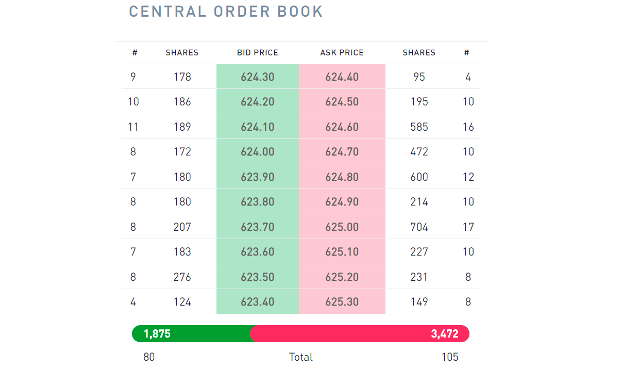

Understanding Order Driven Markets: Functioning and Mechanics

read article Understanding Order-Driven Markets: Transparency and Risk Management in Action In modern financial markets, understanding the mechanics of trading systems is essential for effective investment decision-making and financial risk management. One of the most influential systems used today is the order-driven market, a structure that plays a central role in global equity exchanges like […]

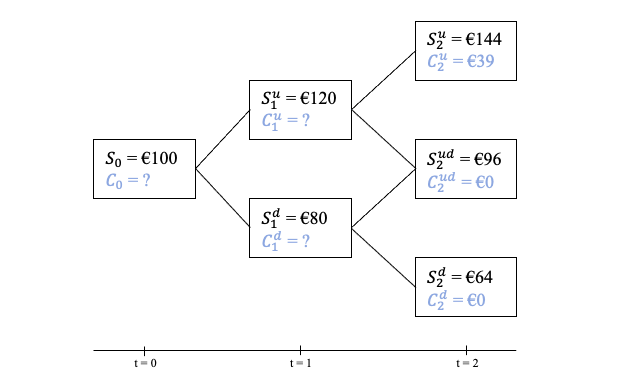

Unraveling the Mystery: How is the Price of a Derivative Determined?

Read article Understanding Derivative Pricing: A Key Element of Financial Risk Management In today’s dynamic financial markets, derivatives are essential tools in risk management, offering tailored solutions for hedging, speculation, and arbitrage. But how exactly is the price of a derivative determined? At Amsshare, we aim to demystify this process using industry-standard pricing methodologies, while […]

Comparison of the prescribed model on predicted returns by the ESMA to a sophisticated time-series model

Read article Evaluating ESMA’s Return Forecasting Model: A Case for Data-Driven Risk Management Introduction In an era marked by growing complexity and regulation in financial markets, financial risk management has never been more crucial. For European fund managers, the European Securities and Markets Authority (ESMA) plays a central role in shaping compliance standards—for exaxmple through the Key […]