Risk solutions for asset managers

Built on EU

regulations

- Liquidity Management Tools

- Liquidity Stress Testing

- PRIIPs KID/EID modelling

Portfolio risk

insights

- Idiosyncratic risk vs systemic risk

- Market, credit and liquidity risks

- Scenario analysis and stress tests

Smart risk

tools

- Only when automation helps

- Lightweight, reusable and fast

- No complexity, no lock-in

What sets us apart

We help asset managers comply with EU regulations and strengthen portfolio risk management beyond compliance purposes.

EU regulations like LMT, LST and PRIIPs KID/EID form the backbone of our risk framework. Beyond compliance, we help asset managers strengthen their overall risk framework through clear modelling and reporting of idiosyncratic, systemic, market, credit and liquidity risks.

We combine deep risk expertise with smart and efficient tooling, used only when automation truly adds real value. Unlike large corporate companies with heavy software setups, we deliver smart and long-term risk solutions without locking you into complex systems.

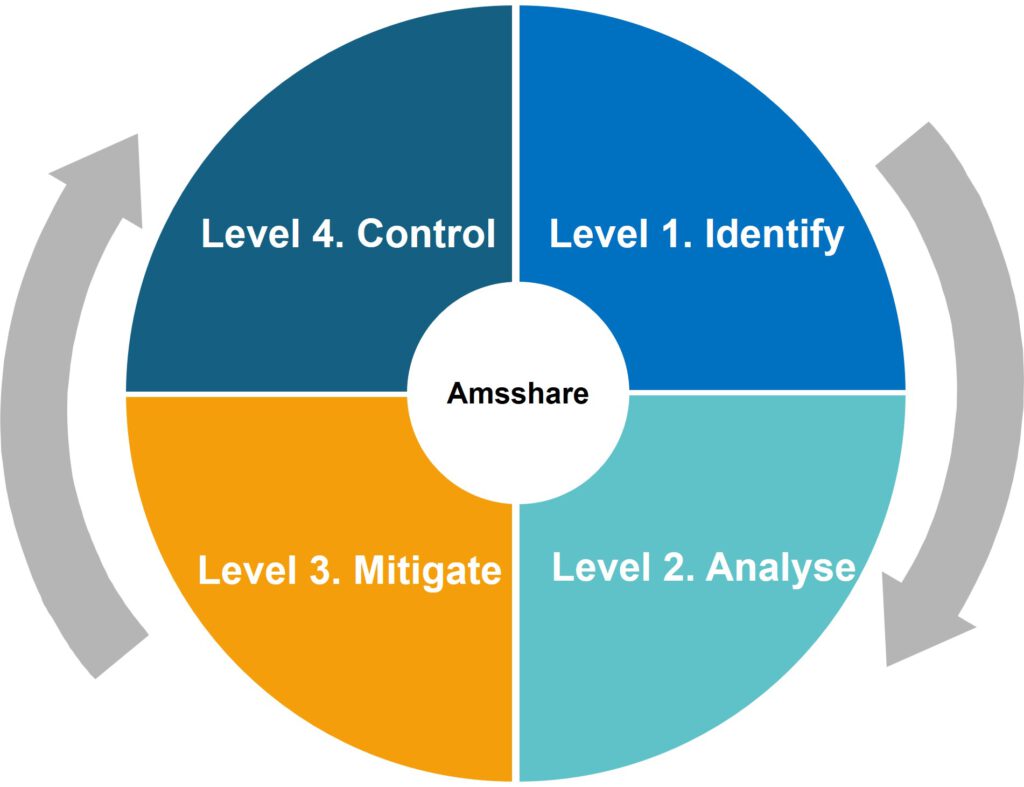

How our risk framework works

We use our four-level risk framework to assess and improve existing risk setups. It serves as a benchmark for performing gap analyses, helping asset managers identify which areas of their risk and compliance processes can be strengthened. This can relate to specific regulatory requirements or to broader aspects of risk management like systemic and idiosyncratic risks.

Level 1: Identify

You see how your assets are spread, how your fund performs over time and what your investor flows and liabilities look like. This gives you a solid foundation to understand your risk.

Level 2: Analyse

Building on Level 1 insights, we help you perform deeper fund analyses – fully aligned with EU rules. Beyond compliance, you get insights into systemic, idiosyncratic, market, credit and liquidity risks. For instance, by building custom tools, running VaR models, stress tests and scenario analyses.

LMT

- Analyse fund liquidity to justify LMT choices

- Implement quantitative LMTs and Anti-Dilution Tools (ADT)

- Build dashboards, set up documentation and integrate policies

LST

- Set up idiosyncratic, market-wide and combined stress tests

- Implement LST tools and determine frequency of LST

- Build dashboards, set up documentation and LST policies

PRIIPs KID/EID

- Generate monthly performance scenarios

- Calculate and validate Summary Risk Indicators

- Update and analyse cost impact figures

- Build historical performance charts (ESMA layout)

- Automate recurring updates and support documentation

Level 3: Mitigate

We help you define limits for market, credit and liquidity risks, based on your fund’s profile and regulations. You’ll know what actions to take if limits are crossed. This gives you practical tools to manage risk before it becomes a problem.

Level 4: Control

All risk data and limits come together in clear reports and dashboards. Risk becomes part of your regular meetings and decisions. We help you track thresholds from Level 3, update scenarios and keep everything transparent.

1. Liquidity Management Tools (LMT)

Liquidity Management Tools (LMTs) are now a mandatory part of the regulatory framework for UCITS and open-ended AIFs. Fund managers are expected to justify their selection of tools, implement quantitative LMTs (e.g., redemption gates) and Anti-Dilutions Tools (e.g., swing pricing) and ensure the tools are fully embedded in their risk and governance processes.

This regulation introduces new operational and analytical challenges. Managers must be able to assess fund liquidity under different market conditions and document the rationale behind their LMT choices.

The setup involves quantitative modelling, internal policies and transparent reporting. You can read more about how to approach the new LMT guidelines in our LMT article.

Helping you comply with LMT guidelines

- Analyse fund liquidity to justify LMT choices

- Implement quantitative LMTs and Anti-Dilution Tools (ADT)

- Build dashboards, set up documentation and integrate policies

2. Liquidity Stress Testing (LST)

Liquidity Stress Testing (LST) is a regulatory requirement for UCITS, open-ended AIFs and leveraged closed-ended AIFs. It requires fund managers to simulate how their portfolio would behave under stressed liquidity conditions, from both the asset and liability side.

A key challenge for asset managers is designing realistic stress scenarios that go beyond generic shocks. This includes modelling idiosyncratic, market-wide and combined events, and assessing how they affect a fund’s ability to meet redemptions or sell assets.

ESMA’s guidelines require not just the modelling itself, but also a formal LST policy, clear documentation and integration into governance. Under the new LMT rules, liquidity stress testing is a mandatory part of the analysis used to justify which liquidity management tools a fund applies.

Helping you comply with LST guidelines

- Set up idiosyncratic, market-wide and combined stress tests for each fund

- Implement LST tools and determine frequency of LST

- Build dashboards, set up documentation and LST policies

3. PRIIPs KID/EID

The PRIIPs regulation requires asset managers of UCITS, open-ended AIFs and some closed-ended funds to publish and maintain a Key Information Document (KID) or Essential Information Document (EID) for retail investors. These documents must meet strict calculation and formatting rules set by ESMA, ensuring product transparency and comparability.

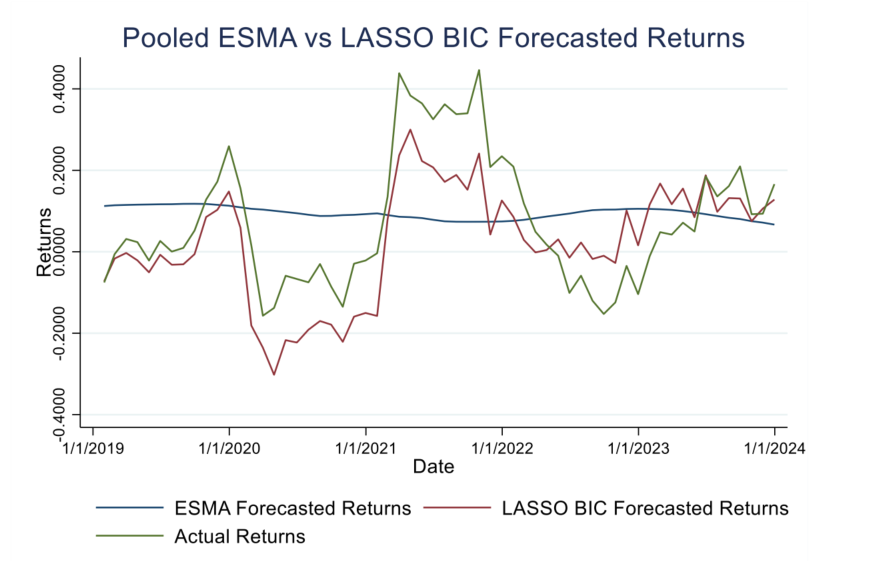

Each KID includes four key components: performance scenarios, a summary risk indicator, the cost impact on returns and historical performance. Performance scenarios must be updated monthly and made public, while the other indicators require at least annual updates.

Maintaining a compliant KID involves regular risk modelling. When done well, these documents not only meet regulatory requirements but also offer insights that enhance portfolio risk oversight.

Helping you comply with PRIIPs KID/EID guidelines

- Generate monthly performance scenarios

- Calculate and validate Summary Risk Indicators

- Update and analyse cost impact figures

- Build historical performance charts (ESMA layout)

- Automate recurring updates and support documentation