Quantitative services

ESMA-Compliant Fund KIDs

We ensure – using our pre-built models – that your fund’s KID and all ESMA-mandated calculations, including those not published in the KID but required elsewhere, are fully compliant with ESMA regulations: Commission Delegated Regulations (EU) 2017/653 and (EU) 2021/2268.

Performance Scenarios

Summary Risk Indicator

Cost tables

Historical Performance

DORA-Compliant Solutions

We developed Lumi Flow to automate the classification, reporting and monitoring of ICT incidents in line with DORA regulations starting January 17, 2025.

AI Tools

We develop tools driven by AI designed to boost innovation and efficiency. While we continue developing new tools, our first offerings are already available.

KID Compliance Tool

ESMA-Compliant Fund KIDs

We ensure – using our pre-built models – that your fund’s KID and all ESMA-mandated calculations, including those not published in the KID but required elsewhere, are fully compliant with ESMA regulations: Commission Delegated Regulations (EU) 2017/653 and (EU) 2021/2268.

Performance Scenarios

Summary Risk Indicator

Cost tables

Historical Performance

DORA-Compliant Solutions

We developed Lumi Flow to automate the classification, reporting and monitoring of ICT incidents in line with DORA regulations starting January 17, 2025.

AI Tools

We develop tools driven by AI designed to boost innovation and efficiency. While we continue developing new tools, our first offerings are already available.

KID Compliance Tool

Our KID service - Aligned with ESMA regulations

Since January 1, 2023, the European Securities & Market Authority (ESMA) has mandated that fund managers need to publish their KIDs in compliance with Commission Delegated Regulations (EU) 2017/653 and (EU) 2021/2268. We ensure – using our pre-built models – that your fund’s KID and all ESMA-mandated calculations, including those not published in the KID but required elsewhere, are fully compliant with ESMA regulations. While we take care of the compliance work, you can focus on what matters most: running your business. This service consists of the following four components, which are briefly listed below and then described in more detail further down:

- Performance Scenarios

- Summary Risk Indicator

- Cost Tables

- Historical Performance

Performance Scenarios

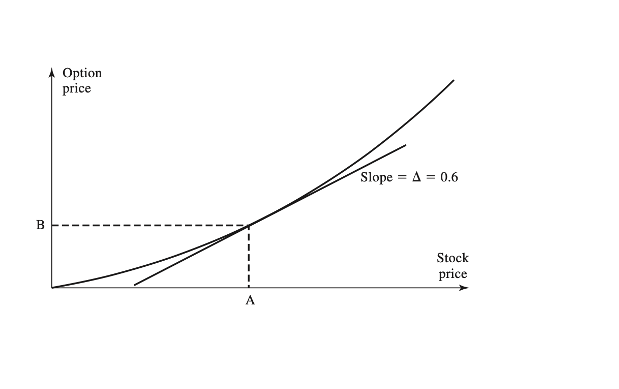

We provide you with the Performance Scenarios for your funds on a monthly basis, allowing you to publish the results as mandated by Article 8, paragraph 3b, of Commission Delegated Regulation (EU) 2021/2268. These scenarios include stress, unfavourable, moderate and favourable scenarios across multiple time horizons.

Summary Risk Indicator

We provide you with the SRI, MRM and CRM results on a weekly, monthly, quarterly or annual basis. The Summary Risk Indiciator (SRI) is a combination of Credit Risk (CRM) and Market Risk (MRM), with the SRI ranging from 1 to 7. Credit Risk is assessed by the weighted average of the credit ratings and market values of the fund’s underlying exposures. The Market Risk is measured by the VaR-equivalent volatility (VEV). Annual reporting is mandatory, and from a risk management perspective, we recommend at least quarterly assessments to mitigate potential Credit and Market Risks.

Cost Tables

The KID includes two cost tables: (1) Composition of Costs and (2) Costs over Time. The Composition of Costs table provides an overview of the charges applied to the customer, while the Costs over Time table illustrates the annual impact of these costs on the investment. We provide you with both tables for the annual KID update.

Historical Performance

The KID must contain a link to the webpage where the fund's Historical Performance Bar Chart is published. This chart displays a time-series covering the past 5 or 10 years, depending on the fund's inception date, and should include the most recent full calendar year. A comparison between the fund and its benchmark should be clearly visualised, and the chart must comply with ESMA regulations regarding layout. We provide you with the Historical Performance Bar Charts for your funds as part of the annual KID update.

DORA-Compliant Solutions

The Lumi Flow software is designed to take the complexity out of DORA compliance. It streamlines the process of classifying, reporting and monitoring ICT incidents, ensuring your organisation stays aligned with the regulations coming into effect on January 17, 2025. With automation at its core, Lumi Flow helps you save time, reduce manual mistakes and simplify work.

AI Tools

AI offers numerous possibilities for businesses, and we are actively exploring and developing tools to enhance your business’s efficiency. We create AI tools for internal use and for publication on your website. Additionally, you can take advantange of AI tools already developed by Amsshare. If you’re interested in learning more, feel free to get in touch.

1) KID Compliance Tool

The KID Compliance Tool is designed to review your fund’s KID for compliance with EU regulations. We’d be happy to assist with checking your KID using our AI-powered scanner.

Effortless Compliance: Simply send us the KID of your fund, and we handle the rest. You'll receive a detailed compliance report.

Time-Saving Automation: No need to study complex regulations - our tool automatically checks compliance with ESMA standards, saving you valuable time.

Thorough Checks: Our tool conducts comprehensive textual and quantitative assessments, ensuring your KID meets the ESMA regulations.

Pricing: We provide the first compliance check for free. Subsequent checks will incur a fee to ensure our service remains sustainable. If you engage us to make the quantitative parts of your KID compliant, future scans will be complimentary as part of our service.

Recent articles

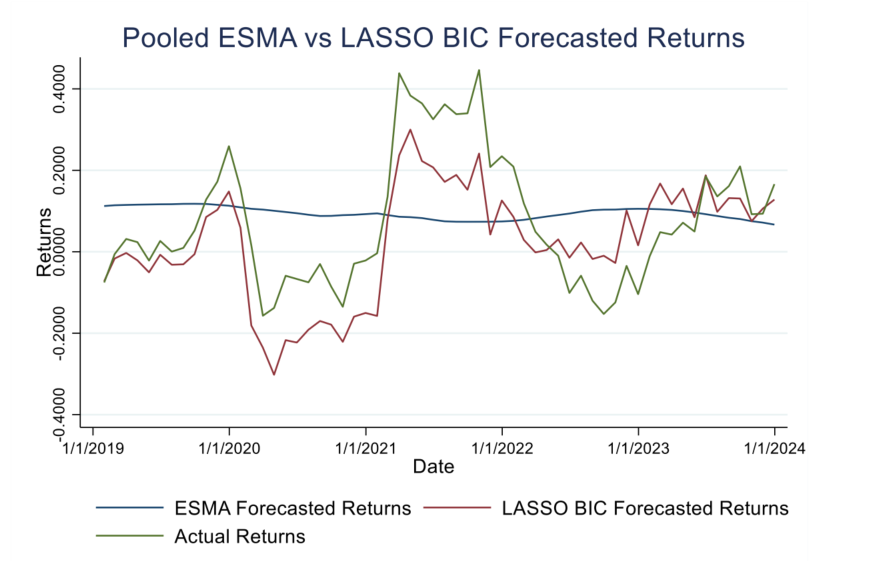

ESMA vs LASSO BIC Forecasting

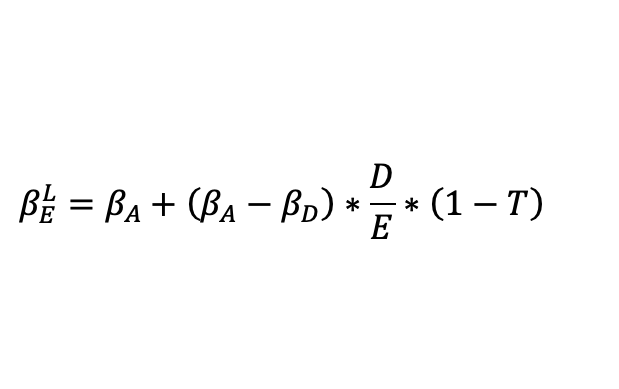

The unlevered and levered CAPM betas: Real-life example of Adyen 2022