Fund Agents for Financial Firms

Save time and money with operational and investor fund agents

We specialise in building custom fund agents for AIF and UCITS fund managers. Our focus is on improving efficiency – both for internal teams and for the investors these managers serve. That’s why we build two types of agents.

- Operational fund agents automate internal repetitive tasks and reduce manual workload.

- Investor fund agents make it easy to discover and compare funds, helping to increase investor interest.

Fund agents are like extra team members, capable of learning exactly what matters to you. We can train them with the knowledge you provide, ensuring they match your company’s needs. Ready to get started? Let’s discuss your fund agent.

We equip agents with customised features trained on your data. For instance, data retrieval via RAG, built-in calculators, content writing capabilities, natural language processing, task automation and more.

We integrate Investor fund agents into your website and app so clients can interact with them easily. For Operational fund agents, we provide a secure link including authentication.

- Save money, time and effort

- Increase investor interest and reduce support workload

- Demonstrate innovation in a changing world.

Ready to explore what fund agents can do for you? Let’s discuss.

Explore use cases for financial firms

Discover a few examples of how fund agents improve operational efficiency and enhance investor interactions. These use cases highlight what’s possible, but the opportunities don’t stop here. Have a specific need in mind? Feel free to reach out to us.

Advanced Fund Comparisons

Smart Investment Simulations

FundScenario AI helps future investors and current clients get a better feel for potential investment outcomes. By simulating various market scenarios, it offers deeper insights into fund performance. Let’s build FundScenario for your firm.

Automated KID Compliance Check

KID Compliance AI checks if a fund’s KID meets ESMA regulations. We built it to replace the slow, manual review processes. Now, we simply upload the KID and the agent scans it line by line against ESMA regulations. We use it to identify fund managers who might benefit from our KID risk management services. This is a great example of how a fund agent significantly improved our operational efficiency. Want your KID checked? Request your KID compliance check.

How we develop the Fund Agents

Step 1: Define the AI Workflow

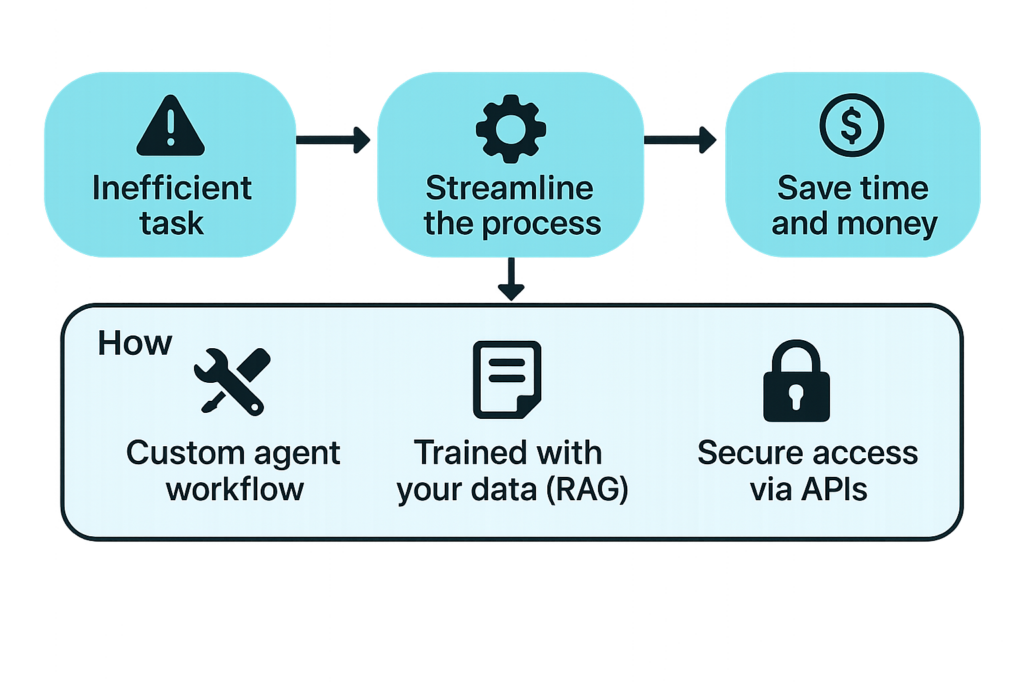

We analyse the problem and sketch a solution, as shown in the diagram. This helps us map the process to define sub-agents and select the best AI models, like OpenAI and Gemini models.

Step 2: Implement & Train

We develop and deploy the workflow using programs like Flowise and n8n, which bring the agent to life. It is then trained with your firm’s data to ensure accuracy.

Step 3: Launch

We integrate Investor Fund Agents into your website or app for client use. For internal use, we provide a secure link.

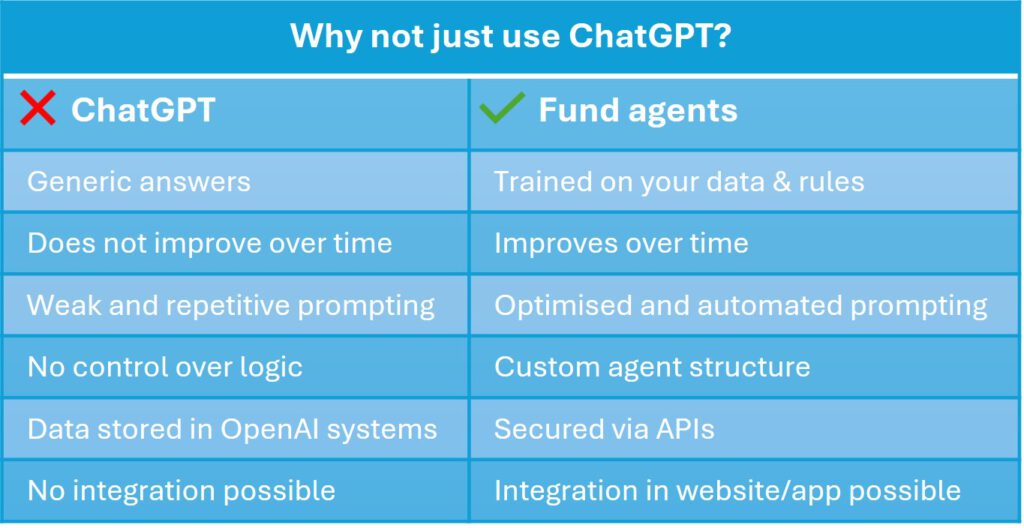

Ensuring Data Privacy & Security

You have full control over which data our Fund Agents use, ensuring information stays protected. Also, our agents connect to AI models via secure APIs, rather than general AI interfaces like ChatGPT. Using APIs provides key security advantages – your business data is not used for AI training and all interactions follow strict encryption and security standards. Learn more about OpenAI’s API security here. If needed, we can connect the agents to open-source models, offering even more data privacy. However, since open-source models often perform worse than closed-source ones, we only recommend this for highly sensitive data.

At Amsshare, we take data privacy seriously. Our approach ensures that you stay in control, maintain security and use AI solutions that align with your privacy needs.

Explain How The Diagram Works

This Fund Agent is designed to assist investors in analysing investment funds of financial firms. The diagram shows how the agent, powered by a Large Language Model (LLM), processes user queries while remembering past interactions via an SQL database.

Agent 1 acts as a routing agent, directing queries to specialised sub-agents based on the type of request:

- Agent 2 retrieves data on individual investment funds.

- Agent 3 compares multiple investment funds.

- Agent 4 handles investment calculations and projections.

How it works – example queries:

- “What was the return of Fund X in 2024?” → The routing agent (Agent 1) sends this query to Agent 2, which retrieves the data via Retrieval-Augmented Generation (RAG). Agent 5 then processes the data and formulates an accurate answer.

- “How do the costs of Fund X and Y differ?” → Agent 1 sends this query to Agent 3., which retrieves and compares fund costs using RAG. Agent 5 then delivers a concise comparison.

- “If I invest €10.000 in Fund X, what’s it worth in 10 years?” → Agent 1 directs this request to Agent 4, which runs investment projections using calculation tools. The result is verified by the Conditional Node, ensuring accuracy before delivering the response. If needed, the system loops back for recalculations.

This is a simplified example. The system can be customised with enhanced features, additional sub-agents or other specialised tasks.

Do They Replace Humans?

No. Our focus is on enabling more efficient operations and smarter investor interactions. AI isn’t the solution – efficiency is. We just use AI as the engine behind it.

Let's develop your custom Fund Agent

Whether you just have a few questions or are ready to take the next steps, feel free to reach out to us. Fill out our contact form or email us to get started.