Financial Risk Management for Investment Funds

Custom Risk Insights

We help investment funds enhance risk management and gain greater control over market, credit and liquidity risks.

- Stress testing

- Scenario analysis

- Risk dashboarding

- Risk modelling

Key Information Documents

We help investment funds maintaining up-to-date KIDs, ensuring ESMA compliance.

- Performance scenarios

- Summary risk indicator

- Cost tables

- Historical performance

DORA ICT Incident Compliance

From January 17, 2025, financial firms must meet DORA requirements. Our software automates compliance.

- Incident classification

- Incident reporting

- Incident monitoring

Custom Risk Insights

We help investment funds enhance risk management and gain greater control over market, credit and liquidity risks.

- Stress testing

- Scenario analysis

- Risk dashboarding

- Risk modelling

Key Information Documents

We help investment funds maintaining up-to-date KIDs, ensuring ESMA compliance and better risk oversights.

- Performance scenarios

- Summary risk indicator

- Cost tables

- Historical performance

DORA ICT Incident Compliance

From January 17, 2025, financial firms must meet DORA requirements. Our software automates compliance.

- Incident classification

- Incident reporting

- Incident monitoring

Custom Risk Insights

- How is your portfolio's market risk managed under different stress scenarios?

- How exposed are your assets to macroeconomic shocks?

- Are risk models, such as VaR and CVaR models, in place and up to date?

- Are concentration and counterparty exposures actively monitored?

- Is liquidity assessed regularly, and can assets be withdrawn under stress?

Using techniques such as stress testing, scenario analysis, risk dashboarding and risk modelling, we provide clarity on exposure and resilience – helping financial firms stay in control of market, credit and liquidity risks.

Rather than offering a one-size-fits-all model, we work closely with each firm to design risk solutions that align with their strategies and regulatory requirements.

Whether you’re facing complex challenges or just need a little extra support, we’re here to help.

Join other financial firms in taking more control of risk. Fill out our contact form or email us to strengthen your risk management today.

Use cases

Challenge

An index fund manager needed to assess fund performance under different market scenarios – but lacked time and resources.

Solution

We created a flexible scenario model, allowing adjustments to asset mix, volatility and correlation assumptions. The model is calibrated to MSCI World benchmarks to show index alignment.

Result

The team gained clear insights into downside and upside potential – quickly, visually and without manual effort.

Challenge

An active equity fund manager needed a reliable way to monitor market, credit and liquidity risk across portfolios – but lacked internal capacity.

Solution

We built dynamic models and dashboards based on custom risk metrics.

Result

Though their team is busy with other day-to-day tasks, they still monitor risks efficiently.

Challenge

A multi-asset fund manager no longer wanted to rely on external VaR metrics from Bloomberg, as calculations were unclear and felt like a black box.

Solution

We built a transparent, user-friendly model that clearly shows how VaR evolves over time. It incorporates multiple methods, including Cornish-Fisher expansions, for deeper insights and greater flexibility.

Result

The team has full visibility into risk calculations and greater control over how market risk is measured.

Key Information Documents

Investment funds must maintain up-to-date Key Information Documents (KIDs) to comply with ESMA regulations. Some KID indicators require monthly updates, while others need annual revisions. We ensure full compliance while also integrating KID updates into your broader risk management strategy, providing valuable insights to enhance risk oversight. Our KID solutions address specific needs, covering four key components outlined below.

⚠️ Performance scenarios must be updated monthly under ESMA standards and made publicly available. Other KID indicators require at least annual updates to remain compliant.

Multiple investment funds trust us for KID compliance and risk management. Ready to enhance yours? Fill out our contact form or email us to get started.

We’ve developed the KID Compliance Agent, which automatically verifies your fund’s KID compliance with ESMA regulations. Learn more about KID Compliance AI.

Performance Scenarios

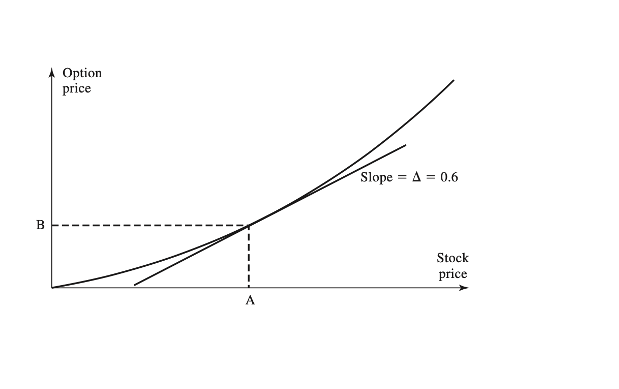

We generate monthly stress, unfavourable, moderate and favourable performance scenarios across different holding periods. Our models align with ESMA requirements, helping investment funds publish compliant KIDs while improving risk assessments and scenario analyses. These scenarios show how your funds might perform over various holding periods under different market conditions.

Summary Risk Indicator

Using our models, we generate the Market Risk Measure (MRM) and Credit Risk Measure (CRM), which together forms the Summary Risk Indicator (SRI). Our methods ensure compliance with ESMA regulations, providing fund managers with key risk insights that enhance market and credit risk management.

Cost Tables

Our cost composition tables and cost-over-time tables offer a transparant breakdown of fees for investors. The composition table outlines the applied fees, while the cost-over-time table projects the annual cost impact on investments. Both tables comply with ESMA disclosure regulations.

Historical Performance

Our historical performance charts provide benchmark comparisons and follow the ESMA layout requirements, ensuring compliance. These charts improve fund transparancy and help investment firms publish compliant KIDs.

DORA Solutions for Financial Firms

Starting January 17, 2025, financial firms must comply with DORA ICT requirements for managing and reporting ICT incidents. Our software, Lumi Flow, automates incident classification, reporting and monitoring. We use our software to assist financial firms with automated DORA compliance. Watch the video to discover how Lumi Flow simplifies compliance.

- Incident Classification

- Incident Reporting

- Incident Monitoring

Simplify DORA compliance with automation. Let’s discuss how by filling out our contact form or emailing us.

Explore our insights on Finance & Risk Management

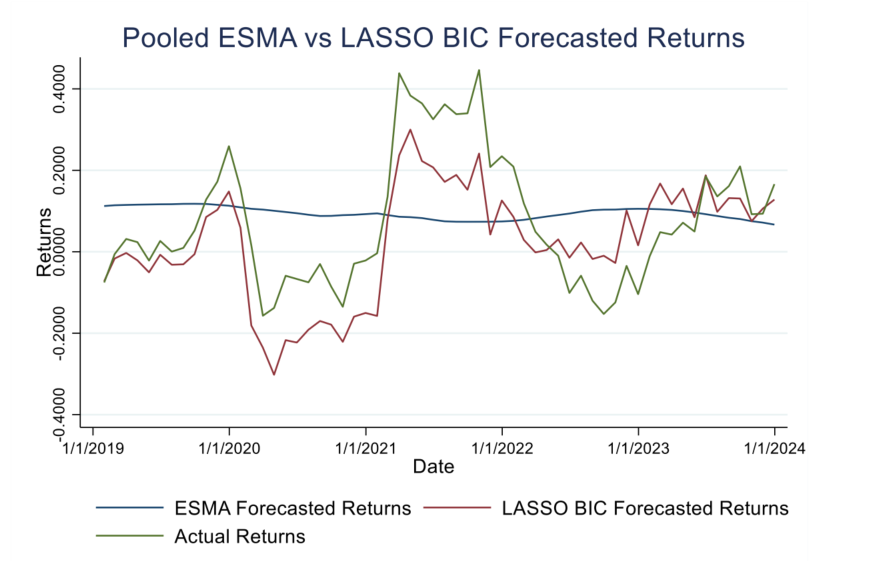

ESMA vs LASSO BIC Forecasting